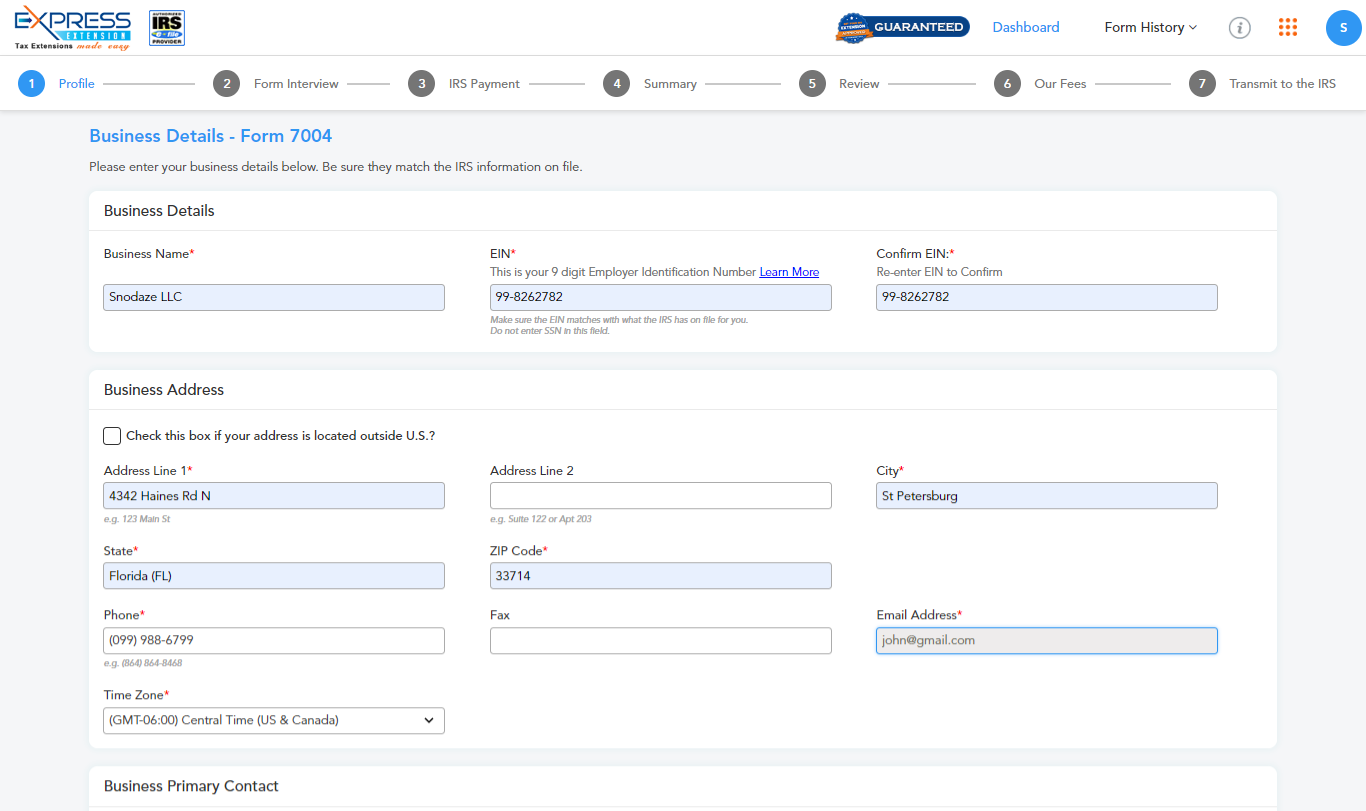

How to E-file IRS Form 7004 Online?

Ready to file Form 7004 with ExpressExtension?

Request an Extension Now

Why Choose ExpressExtension to

E-File Form 7004?

ExpressExtension, the IRS-authorized e-file provider, provides you with the ideal way to file

File Form 7004 online. Here are some of the reasons why you should choose ExpressExtension to file your

tax

extension forms.

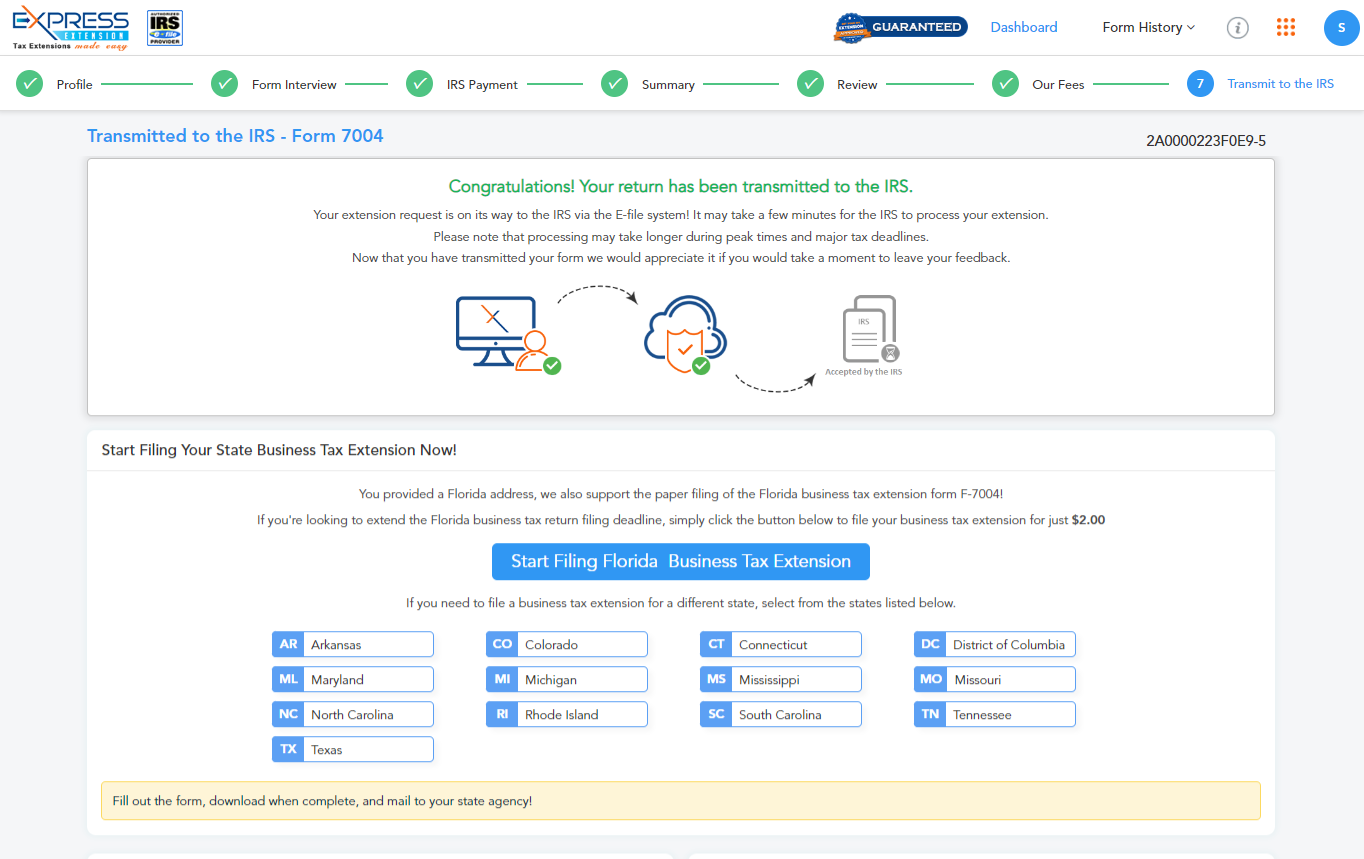

Supports IRS & State Tax Extension

Get your IRS Extension Approved or Money Back

File from any device in Minutes

Bulk Upload Form 7004 Data

Instant Email or Text Notifications

Retransmit Rejected Returns for Free

Bulk filing & Pricing discounts for Tax Professionals

Live Chat, Email, or Phone Support

Volume Based Pricing for Business Owners

| No. of Forms | 1-10 Forms | 11 - 50 Forms | 51 -100 Forms | 101 -250 Forms | 251 -500 Forms | 501 -1000 Forms | 1000+ Forms |

|---|---|---|---|---|---|---|---|

| Form 7004 (Price per form) |

$19.95 | $17.95 | $15.95 | $13.95 | $11.95 | $9.95 | Contact us for Bulk Pricing 803.514.5155 |

Volume Based Pricing for

Business Owners

| No. of Forms | Form 7004 (Price per form) |

|---|---|

| 1-10 Forms | $19.95 |

| 11-50 forms | $17.95 |

| 51-100 forms | $15.95 |

| 101 - 250 Forms | $13.95 |

| 251 - 500 Forms | $11.95 |

| 501 - 1000 Forms | $9.95 |

| 1000+ Forms | Contact us for Bulk Pricing 803.514.5155 |

See why our customers choose us year after year

ExpressExtension - The Smart Business

Owners Choice

Frequently Asked Questions

What is the purpose of Form 7004?

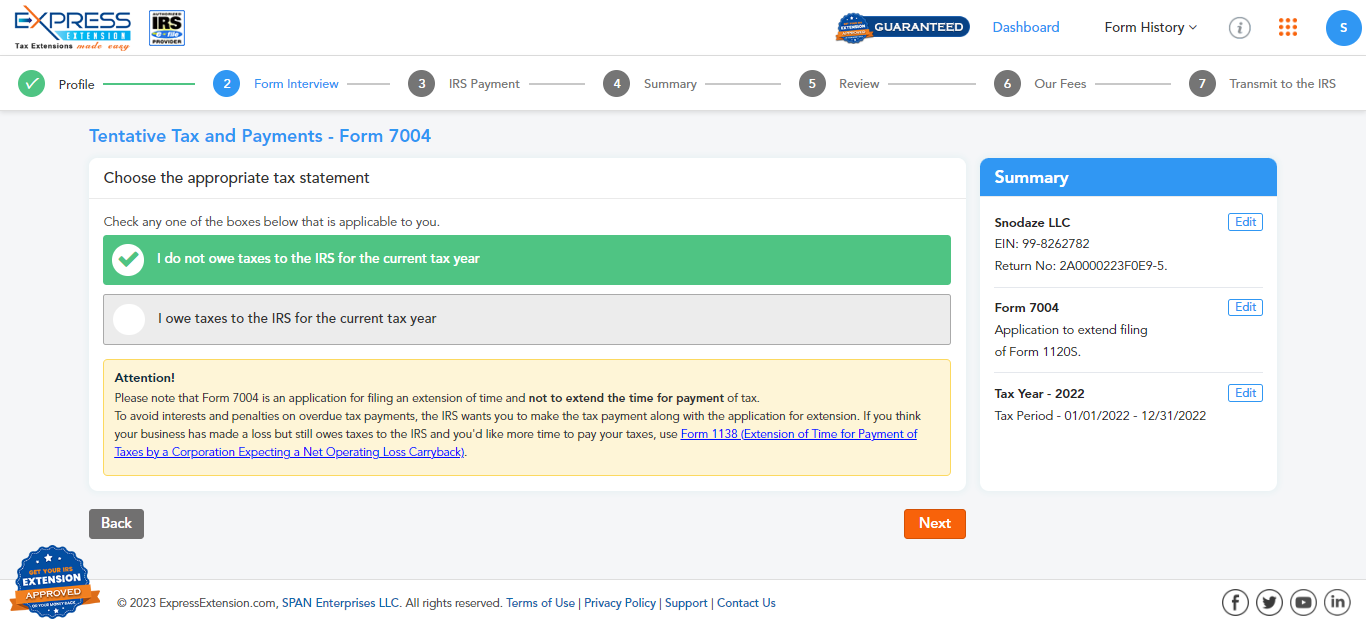

Form 7004 is an extension form used by businesses to request a 6-month extensionto file business income tax returns. It is completely automatic, and no explanation is required to request an extension.

Note: Filing IRS Form 7004 does not extend the time to pay

your tax.

The extension gets granted only if you properly complete and file Form 7004 with the IRS and make proper estimates of owed taxes (if applicable on or before the due date).

Visit https://www.expressextension.com/form7004extension/business-tax-extensions/ to know more about the filing of

Form 7004.

For what forms can I extend the deadline using Form 7004?

The deadline for filing the following tax returns can be extended using Form 7004

- Form 1120-S

- Form 1065

- Form 1042

- Form 1065-B

- Form 3520-A

- Form 8612

- Form 8804

- Form 1066

- Form 1120

- Form 1120-F

- Form 1120-FSC

- Form 1120-H

- Form 1120-L

- Form 1120-ND

- Form 1120-ND (Section 4951 taxes)

- Form 1120-PC

- Form 1120-POL

- Form 1120-REIT

- Form 1120-RIC

- Form 1120-SF

- Form 1041 (estate other than a bankruptcy estate)

- Form 1041 (Trust)

- Form 1041 (bankruptcy estate only)

- Form 706-GS (D)

- Form 706-GS (T)

- Form 1041-N

- Form 1041-QFT

- Form 1066

- Form 8831

- Form 8928

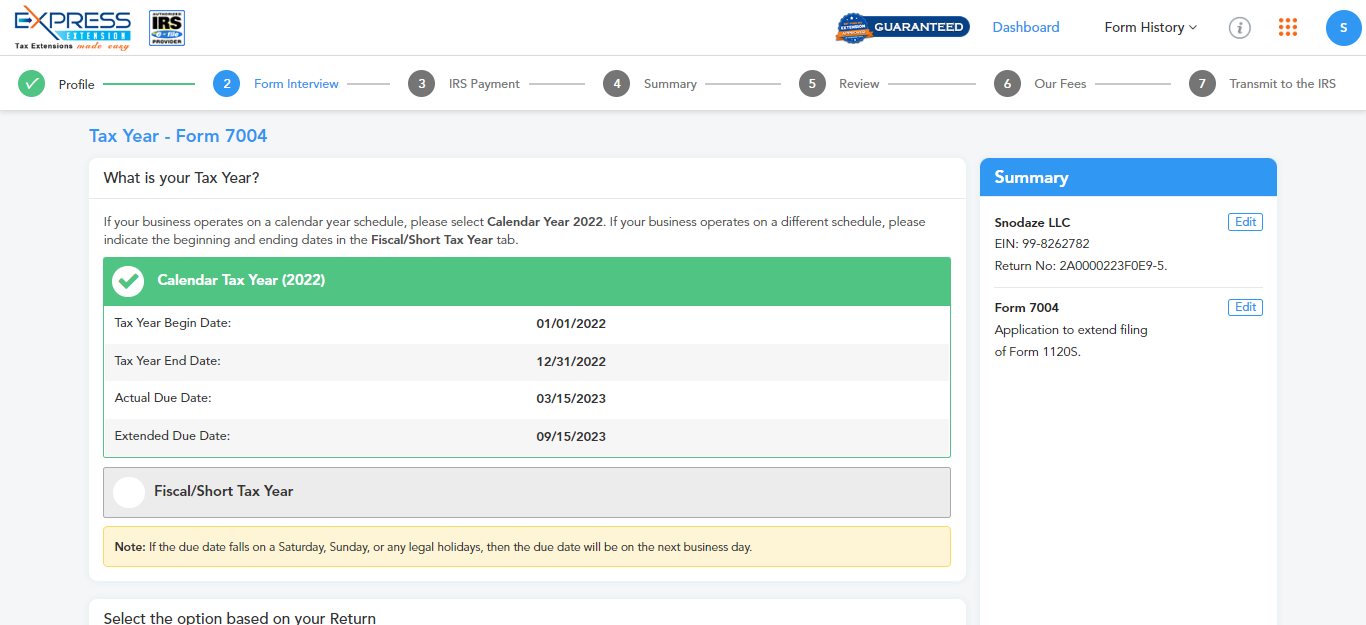

When is the due date to file

Form 7004?

The deadline to file Business Tax Extension Form 7004 depends upon the type of forms for which the extension is being requested.

- 15th day of the 3rd month for certain tax returns such as 1120-S, 1065, and more (For organizations following the calendar tax year, the deadline is on March 15).

- 15th day of the 4th month for certain tax returns such as 1120, 1041, and more (For organizations following the calendar tax year, the deadline is on April 15).

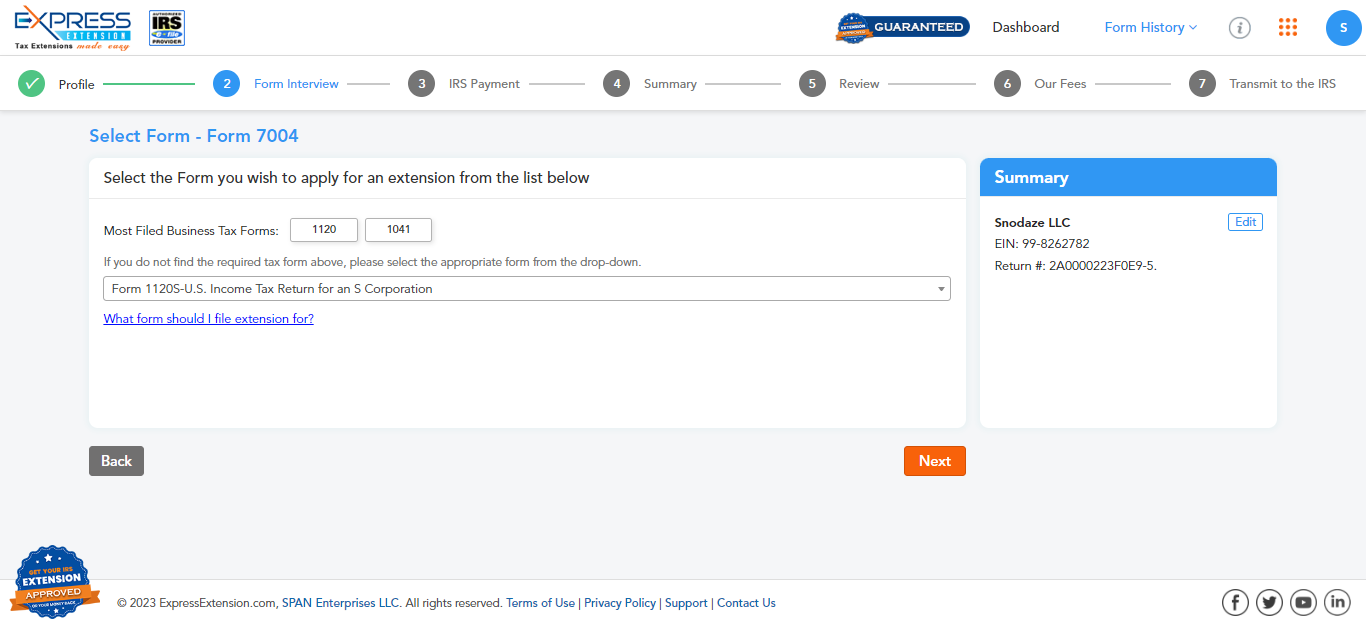

How to file Business Tax Extension?

- By using IRS Form 7004, you can apply for a business tax extension Form 7004 and get 6 months of additional time for filing your business income tax returns.

- You can use either the paper filing or E-Filing method to file Form 7004 with the IRS.

- IRS recommends businesses file Form 7004 electronically. E-filing saves time and avoids filing unnecessary paperwork.

Helpful Resources